Article in the e|m|w – newspaper: From smart greening to ESG

Living sustainability instead of green washing

In light of the Corporate Sustainability Reporting Directive (CSRD) and increasingly demanded initiative around Environmental Social Governance (ESG), strategic foresight, prudent preparation and appropriate tools are required when implementing greening projects.

Against the background of the targeted climate neutrality, more and more (energy-intensive) companies are starting projects to minimize their carbon footprint. Companies with more than 250 employees, net sales of more than 40 million euros or total assets greater than 20 million euros are also required by the Corporate Sustainability Reporting Directive (CSRD), which will be adopted by law by the EU in October 2022, to report comprehensively on the non-financial impact of their actions. This means that they must record the effect of sustainability factors on the economic situation of the company as well as clarify the influence of operations in the context. The deadlines for implementation vary depending on the size of the company from 2025 (fiscal year 2024) to 2028 (fiscal year 2027). According to estimates by the German Sustainable Business Association (BNW), this will increase the number of companies in Europe subject to reporting requirements from 11,700 to over 50,000. In Germany, more than 15,000 companies would be affected.

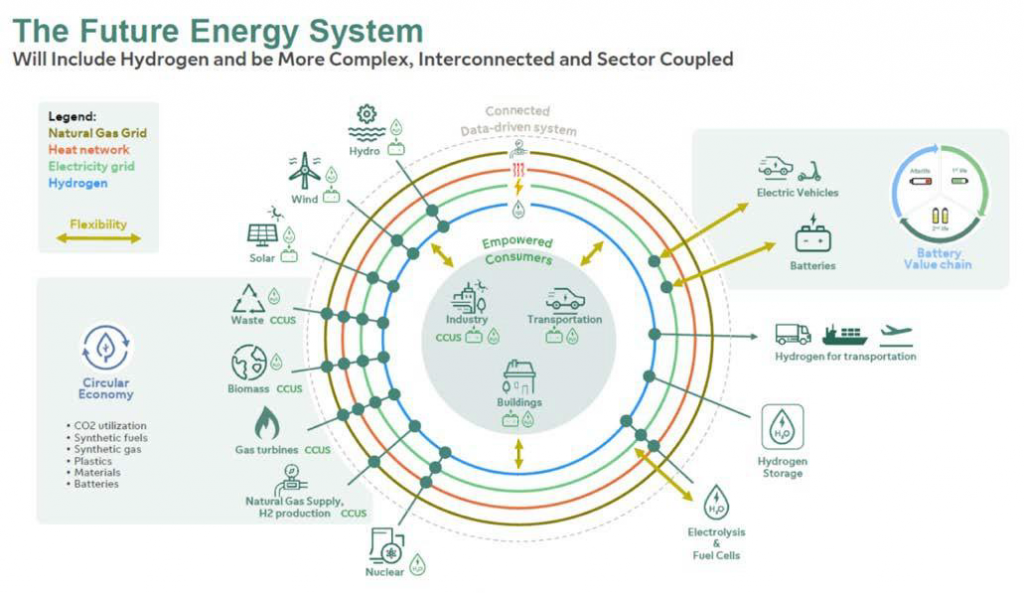

With regard to the timely integration of greenhouse gas-reducing projects and suitable reporting tools, the demand for greening measures will increase strongly in the coming months. Those who want to achieve their goals not just by reacting, but by prudently and actively driving them forward, should consider two key points: First, the diverse energy systems of the future and second, the link to future ESG specifications. This is because, in addition to the immediately pending environmentally relevant implementations, social aspects and responsible corporate governance are increasingly flowing into the evaluation of companies of all sizes. ESG interactions should therefore be taken into account as early as possible. Not only success in achieving climate neutrality determines the reputation of a company, but also, for example, social commitment, inclusion projects or internal daycare facilities. The inclusion of sustainable ESG criteria in the holistic evaluation of a company is now common practice among numerous investors and rating agencies.

Strategic CO2 emissions management

The particular relevance of the topics of energy and environmental sustainability is beyond question. In view of the rising cost of CO2 emission certificates to as much as 180 euros per ton by 2030, it is also worthwhile for small and medium-sized enterprises (SMEs) to launch greenhouse gas reduction programs in good time – especially since many companies demand that their suppliers comply with the same environmental and sustainability standards. Instead of lapsing into blind actionism and acquiring any green electricity or emission certificates, for example, it is advisable to first take a closer look at the entire energy procurement process as part of a comprehensive analysis and to determine the full energy costs incurred. After all, what use is a green electricity certificate from the European Energy Certificate System (EECS-GO) or the International REC Standard (I-REC Standard) if they do not apply in the very countries in which production takes place?

Based on individual sustainability aspirations as well as local budget and regulatory requirements, appropriate tools and packages of measures should be developed and implemented to reduce the carbon footprint and increase energy efficiency. A phased approach is suitable for this, which not only includes inventories/audits, company-specific emission reduction targets and appropriate tools, but also leads to a strategic roadmap based on quantitative analyses. Attention must be paid to a holistic strategy so that future ESG requirements can be addressed. For example, planned power purchase agreements (PPAs) should still fit the company’s ESG strategy ten years from now. The same applies to the switch to environmentally friendly technologies, the implementation of which requires major investments – with a long ROI time window.

Find and apply suitable instruments

A wide range of options is available for successful greening transformation, which must first be identified and evaluated for suitability. Since many SMEs, unlike large corporations, do not have their own energy procurement department, it is advisable to seek the support of an external energy expert who has an eye on all aspects of energy procurement security. The ideal partner not only advises and provides metrics or reports, but also actively accompanies and supports the company throughout the entire transformation process in the development and integration of the tools. In addition, he should vouch for the effectiveness of the optimizations with the practical implementation. Tools that can help minimize the carbon footprint include:

- Verified and accepted certificates of origin

- Verified green electricity labels/labels

- Switching to green power sources (photovoltaic, biogas, hydropower) and PPAs (long-term power purchase agreements).

- Joint ventures (for example with wind farms)

- Use of green process heat for industry (Concentrated Solar Power (CSP), Bio methane, Heat Recovery).

- Carbon capture and storage approaches

- Emission compensation (purchase of compensation certificates, Support for global climate projects)

At the same time, it is crucial to always take into account the latest recommendations, specifications and guidelines of the various environmental initiatives and institutes, for example ISO 14064, Science Based Targets Initiative (SBTi), Global Reporting Initiative (GRI), Aluminum Stewardship Initiative (ASI), etc.

These are always included in the definition of individual company specifications for CO2 reduction and thus ensure legal compliance. They are always taken into account when defining and structuring individual company targets for CO2 reduction, thus ensuring legal compliance. As listed, this can be done via verified certificates that neutralize the company’s CO2 emissions in full or in part.

It is also possible for the company to achieve complete climate neutrality on its own. The focus here is on finding a path toward sustainability that is both ecologically and economically sensible while maintaining competitiveness. To this end, all relevant internal and external requirements must be taken into account. Companies that follow this path benefit from a wide range of market instruments, risk reduction, cost advantages, and budgets for future investments that can be planned over the long term. At the end of this phase model, the company finally holds a valid expert opinion in its hands that documents the results in a CSRD-compliant and legally secure manner.

For successful greening projects, it is advisable to have both a far-sighted and detailed view of the diverse energy scenario of the future. (Graphic: enexion)

Sustainability as a productive factor and asset

While in many places the current CSRD requirements and future ESG requirements are still seen as a chore, if not a threat, there is a noticeable trend, especially among internationally active corporations, but also among young start-ups, to perceive sustainability efforts as a productive factor and to actively implement them. An ESG-compliant company, which is used for the complete life cycle of a product from the cradle to the grave, aims to achieve zero emissions from its processes, improved working conditions in the respective countries, treats its employees fairly and also involved in other social projects, such as the engaged, is simply in a better position to compete for customers thanks to its company valuation. Not only does it find qualified employees more quickly, it is also valued by financial investors. It is therefore advisable – especially for energy-intensive companies – to promote ESG as a strategic goal as soon as possible. And this does not mean the subsequent interpretation of isolated eco-projects, but the inclusion and consideration of sustainability as a serious corporate goal. Because in the meantime a rethinking and a change in values are noticeable in the coming generation, which will make the business world look completely different in 20 years. It can be assumed that ESG will change the business world as profoundly as the introduction of the PC.

Comments are closed